In the vast field of investment options mutual funds have become an option that is favored by millions of investors across the globe. By combining the benefits in professional administration, diversification and accessibility, mutual funds provide the best way to build wealth and meet financial goals. In this thorough guide, we examine the basics in mutual funds. We will also explore the wide variety of options that are available, their advantages and risks, as well as the best ways to maximize your returns while minimizing risk.

What is a Mutual Fund?

Mutual funds are instruments for investing that pool funds from several investors to fund an array of bonds, stocks, and other types of securities. These funds are managed by expert manager of funds who take investments on behalf of investors. This section will explore the inner workings of mutual funds and their structures and the key characteristics which make them attractive investments. Investors who are considering investing in mutual funds will gain insight into the pros and cons of investing in mutual funds for their financial plan.

Benefits of Mutual Funds

This article will discuss the many benefits mutual funds provide to investors. First, diversification is identified as one of the main advantages that the pooling of funds across different securities lowers the risk overall. Additionally, the significance in the management of professionals will be addressed and will highlight how skilled fund managers make use of their expertise to maximize the returns. Furthermore the accessibility and liquidity of mutual funds makes them a desirable alternative for investors with different budgets. The cost-effective aspect will be stressed, as mutual funds permit investors to invest in smaller amounts as compared to direct investment in bonds or individual stocks. In addition investors will gain appreciation of the transparency that mutual funds provide which allows them to track the cost of their investments and return with ease.

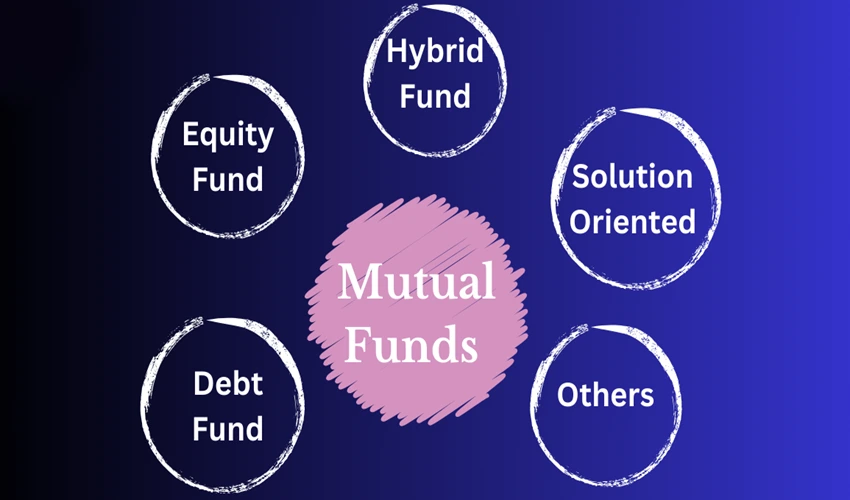

Types of Mutual Funds

This comprehensive section will look at the variety of mutual funds that are available to accommodate different investment goals and risk tolerances. Beginning with equity funds readers will be informed about the possibility of earning large returns from investing in stocks, and the risks associated with it. The debt funds are addressed in the next section, with a focus on fixed-income securities, which makes them ideal for investors who prefer a stable income. Balanced funds, which include both credit and equity instruments will be described as a suitable middle ground for moderate risk-based profile.

The next part will delve in to money market funds that offer low-risk, short-term investment options that are suitable for investors looking for cash flow and preservation of capital. Funds that index will be presented as funds managed passively which aim to mimic the performance of an index. Funds that are specific to a sector will be discussed in detail, describing how they target the investments they make in certain sectors or industries. Funds that save taxes (ELSS) can be discussed as an investment choice that is tax-efficient with a lock-in time. Foreign funds are reviewed to demonstrate how investors can get exposure to markets in foreign countries.

The article will end with an examination of Exchange-Traded Funds (ETFs), which will highlight their similarities and differences from traditional mutual funds, and their growing popularity with investors.

How to Invest in Mutual Funds

This informative segment is designed to provide readers with step-by-step instructions for how to begin investing into mutual funds. The section will start by describing the steps necessary to set up an account with a mutual fund and select a fund that is suitable according to your financial goals, risk tolerance and the investment timeline. The reader will be able to understand the importance of allocation to assets and the best way to build an investment portfolio that is diverse.

The advantages that come with Systematic Investment Plans (SIP) will be explained, showing how investing regularly through SIPs encourages a structured strategy and reduces risk of market timing. Furthermore, the benefits of investing in lump sums will be explored for those with excess funds.

Evaluating Mutual Fund Performance

This section will explore the various metrics used to evaluate the performance of mutual funds. Starting with Net Asset Valuation (NAV) the reader will discover how it measures the value of the fund’s market share. The importance of studying historical data, performance and the risk-adjusted return will be made clear to assist readers make informed choices when choosing mutual funds.

The impact of expense ratios, tracking errors, and turnover in portfolios will be examined to assess the effectiveness and effectiveness of the mutual fund. The significance of benchmarks in measuring the performance of a fund against the performance of its competitors will also be discussed.

Costs and Expenses

This section will provide information on the many costs associated to mutual funds. The expense ratio is explained in terms of a proportional percentage fund’s assets, which are used to pay operating expenses. The concepts of exit load and entry load will be clarified and will highlight how they affect investors when they make purchases or redeem. Furthermore, investors will be warned to keep an eye for hidden costs which could eat away at the investment return.

Risks Associated with Mutual Funds

In order to make informed investment decisions, investors need to know the risks involved to mutual funds. Risks associated with market risk, arising from fluctuations in the market will be examined within the context of how it impacts the value of the portfolio of mutual funds. Risks to credit will be discussed with a focus on checking the creditworthiness of the investment portfolios that are the foundation.

The risk of liquidity will be discussed in order to highlight the issues investors could face when selling their shares of funds. Additionally, the risk of interest rate will be explained and will be a focus on how it affects the debt fund when interest rates fluctuate.

Tips for Investing in Mutual Funds

In order to help readers maximize the value of their mutual fund investments This section will provide useful guidelines and tips. The importance of allocation will be highlighted as an important aspect in making a well-balanced portfolio. The advantages associated with Systematic Investment Plans (SIPs) will be described as a method that is disciplined to investing.

Readers are encouraged to rebalance and review their portfolios regularly to ensure they are in line with their goals for financial planning and the risk tolerance. In addition the importance of adopting an investment view that is long-term will be highlighted to profit from the potential of compounding and to weather the short-term market volatility.

Tax Implications

The article will close by discussing the tax consequences of investing in mutual funds. Readers will learn about the tax treatment of capital gains derived from mutual funds and will be able to distinguish between equity funds and debt funds. The benefits in tax savings funds (ELSS) are highlighted for wealth creation that is tax efficient.

Conclusion

The investment in mutual funds opens an array of opportunities for those who want to increase their wealth and realize their financial goals. When they understand the different kinds of mutual fund, the pros and cons and risks, as well as the best methods for investing, investors can make educated decisions that are in line with their specific financial goals. Armed with this complete guide, investors will be able to easily navigate the maze of mutual funds, and begin on the road to an enviable financial future. Keep in mind that investing comes with inherent risks. Professional financial advice is advised to maximize the investment strategy.